Can Blue Origin Launch TeraWave by 2027?

Feb 13, 2026

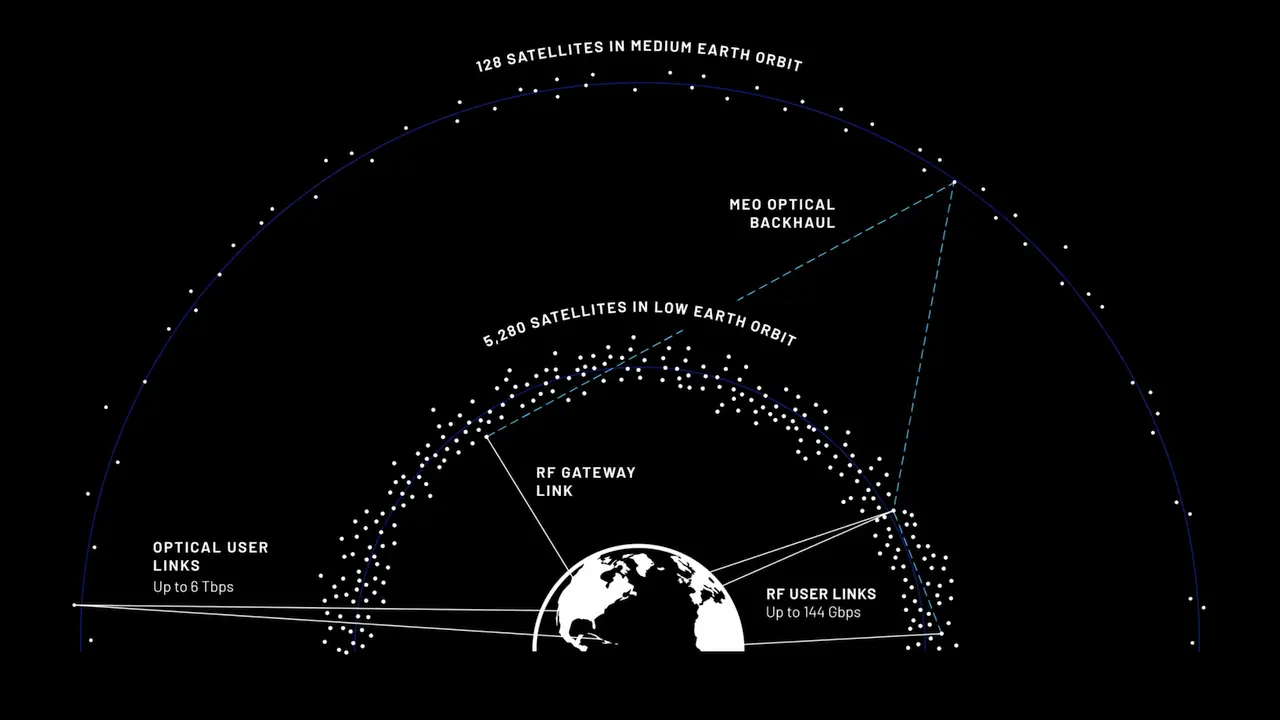

Blue Origin has unveiled TeraWave, an ambitious satellite constellation that marks a clear shift from conventional space-based internet services. The project features a hybrid multi-orbit architecture comprising 5,280 LEO satellites operating between 500 and 1,000 kilometers altitude, complemented by 128 satellites in medium Earth orbit (MEO) positioned between 8,000 and 20,000 kilometers. This dual-layer design enables the constellation to deliver unprecedented data speeds of up to 6 terabits per second through optical interconnections, positioning TeraWave as a premium infrastructure solution rather than a consumer-oriented service. The lower LEO layer will provide direct ground connections with speeds of 144 gigabits per second per satellite, while the MEO layer acts as a high-capacity backbone network utilizing optical links for data transport.

TeraWave constellation promo. Credit: Blue Origin

TeraWave constellation promo. Credit: Blue Origin

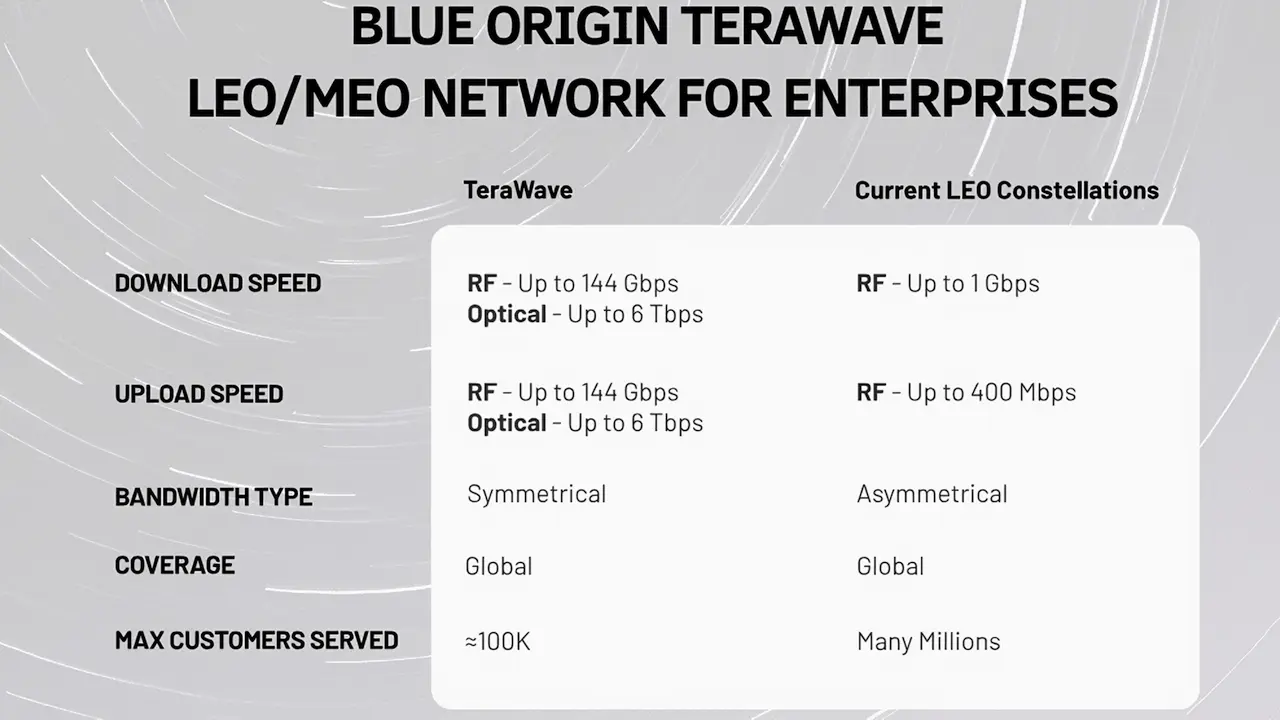

The technical specifications reveal a system designed for exceptional performance and reliability. The 5,408 satellites will all be interconnected through optical links to form a continuous space network capable of symmetrical upload and download speeds. The constellation will operate in Q/V-band frequencies and optical communications, which are still relatively untested at large scale but have potential to provide fiber-like performance from orbit. Blue Origin is also concentrating on business clients, data centers, plus government bodies that demand huge data streams, especially artificial intelligence workloads and mission-critical processes. TeraWave aims to establish a new category in the market of satellite communications with the launch planned to start in the fourth quarter of 2027.

Customer Focus and Market Strategy

Industry analysts highlight that TeraWave is consciously pursuing another segment and is not competing directly with mass-market satellite broadband providers. Independent advisors point out that TeraWave seems laser-focused on enterprise and government scenarios needing ultra-high-throughput connectivity, with a focus on middle-mile and backbone connectivity as opposed to mass-market access. Space industry consultants note that TeraWave is aiming at a whole new market that has not historically been viewed as truly addressable by satellite systems, one that requires very large capacity with correspondingly large and expensive terminals. The constellation is designed to serve approximately 100,000 customers in total, a more limited customer count than consumer-focused networks, reflecting its high-end focus and niche uses.

TeraWave constellation promo. Credit: Blue Origin

TeraWave constellation promo. Credit: Blue Origin

The service is intended to solve specific infrastructure problems where terrestrial solutions prove difficult or unfeasible. TeraWave can be used to directly connect entire data centers and replace long-distance fiber backbones in areas where it is not practical to build networks on the ground. The system provides network redundancy capable of keeping essential services during fiber outages, extreme weather events, cyberattacks, or maintenance events. With single links able to absorb simultaneous traffic from tens of thousands of users, the constellation is aimed at organizations needing enormous data flows, including government agencies, military applications and cloud platform companies. This positioning results in natural separation from other satellite ventures, including Amazon Leo, which, despite sharing Bezos as a key figure, focuses on last-mile access connectivity for broader markets.

Competition and Market Impact

The announcement has sparked different reactions from the satellite industry as to the competitive implications. Research directors at space industry firms have described TeraWave as very much a paper constellation even with Blue Origin’s substantial resources, suggesting that observers shouldn’t get too concerned about presentations and press releases at this point. However, other analysts identified specific operators facing potential disruption, especially those serving the high-capacity enterprise segment. Industry consultants say TeraWave’s capabilities could put pressure on yet-to-launch business-to-business and business-to-government constellations such as Telesat Lightspeed and Rivada Space, though geopolitical pressures to diversify away from U.S.-centric space businesses could give them some resiliency.

TeraWave constellation promo. Credit: Blue Origin

TeraWave constellation promo. Credit: Blue Origin

Space market analysts identified SES’s O3b mPOWER as the most obvious potential competitor, currently serving as the go-to solution for high-capacity needs where terminal size and cost are less critical. O3b mPOWER covers large capacity backhaul and trunking and applications such as cruise ship connectivity, but is limited to 10 gigabits per second per link and would be significantly outclassed by TeraWave if announced performance levels are realized. Beyond American competitors, European players such as Eutelsat via its OneWeb subsidiary are consolidating their positions with new satellite deployments scheduled from 2027 to support European digital sovereignty objectives. These services primarily serve institutional clients and professional use cases, though they target different performance levels than TeraWave’s ultra-premium capabilities.

Technical Challenges and Timeline Realities

Industry experts express considerable skepticism about Blue Origin’s aggressive timeline for deployment and the technical challenges that lie ahead. Space industry researchers stress that TeraWave will require substantial new technology development, noting that the satellite industry has not yet normalized the use of Q/V-band, meaning that significant non-recurring engineering will be required for customer-ready equipment. Ultra-high-capacity optical terminals are another challenge as they are not yet proven outside of limited demonstrations, and symmetrical connectivity is not a feature of satellite broadband systems. Unless Blue Origin began TeraWave development years before the announcement, analysts do not see material launches this decade, let alone in 2027, given the many low-technology-readiness-level features the constellation expects to deploy.

Additional complications include manufacturing capacity, supply chain readiness, and launch vehicle availability. Industry consultants question how quickly the supply chain could respond to produce the volume of Q/V-band user terminals required to meet demand; 2027 is rapidly approaching and quick scaling will be essential. Experts are concerned about the demonstration of network resilience to rain fade, and for Q/V-bands to be a credible backup to optical links, Blue Origin will have to address rain fade mitigation in a convincing way, which does not seem to be a mature or well-proven capability at this stage of development. The timelines are aggressive and history indicates delays are inevitable, although Blue Origin’s advantage lies in its significant financial backing and control over its New Glenn launch vehicle, even as that manifest already appears heavily loaded with commitments to other projects. Despite these challenges, TeraWave’s ambitious vision could redefine enterprise satellite connectivity if Blue Origin successfully navigates the technical and operational hurdles ahead and delivers on its performance promises. For now, the industry watches closely to see whether this “paper constellation” transforms into orbital reality as promised.