Mar 26, 2018

FCC Endorsement for SpaceX

The recent news that SpaceX has launched experimental satellites following FCC approval, has taken the NewSpace industry by storm. Several satellite companies such as OneWeb, LEOSat, and Telesat LEO have been working to develop and manufacture a constellation of LEO (Low Earth Orbit) satellites designed to offer high speed, low latency broadband services to underserved regions of the world. Where these operators are proposing a few hundred satellites in their constellations, SpaceX is proposing to launch almost 12,000 satellites by the mid-2020s. SpaceX says it will be able to provide broadband service up to 1 Gbps for the end user.

What is a LEO Constellation?

LEO satellites operate at much lower distances above the earth, at altitudes around 1,200 km (750 miles). The satellites we are most familiar with are fixed in Geosynchronous Earth Orbit (GEO) about 3600 km (22,200 miles) above the equator. Because they are so far away, there is a lot of delay (latency) using these satellites, and this impacts interactive voice and video traffic, not to mention being detrimental to playing interactive games on the internet. The LEO constellations will have much lower latency, in the neighborhood of 25 – 35 ms, as compared with about 650 ms for GEO satellites. These new satellites will use various techniques such as spot beams and frequency reuse, to significantly increase capacity and deliver higher bandwidth rates to users.

Small, “hot” satellite beams, covering a small area can produce higher speeds than legacy FSS (Fixed Satellite Services) that have much larger beams covering more territory. Because the beams are small, the frequencies used to produce them can be used over and over again in other beams that are far enough away from each other so there is no interference. LEO satellites will constantly orbit overhead, with one coming into view as another goes over the horizon. New flat panel technology will track these satellites as they pass overhead. The SpaceX LEO satellites will communicate with each other in space, and relay traffic from satellite to satellite, to the final destination back on the ground.

Will the Business Succeed?

The real question is whether these new businesses will succeed. Back in 1990, a company called Teledesic was formed to deliver internet service over satellite. They planned a constellation of 840 satellites. That plan was scaled back to 288 satellites in 1997. Teledesic ultimately failed. Would they have fared better today.

Launch Costs Coming Down

There have been many changes in the ensuing years. For one thing, the cost of launches has come down, thanks in large part to SpaceX’s ability to land booster rockets on earth or on a floating platform at sea, permitting them to be reused. This has significantly reduced launch costs, and this trend is likely to continue. SpaceX continues to refine this capability, testing new ways to decelerate their boosters in order to use as little fuel as possible coming back down to earth. The new BFR rocket will have the ability to launch many satellites at the same time, and its boosters will also be reused.

Smaller and Lighter

Another development favoring success, is that satellites are now smaller, lighter and less expensive. Automation is speeding up the manufacturing process – OneWeb for example suggests it can manufacture three satellites per day. An advantage of less expensive satellites is that one can build larger constellations, and any failures are easily routed around

Flat Panel Antennas

At the time of Teledesic, most tracking antennas were gimbal based, which means mechanical antennas rotating on various axis in order to remain pointed at the satellite. If more than one satellite had to be tracked, there had to be more than one antenna. New flat panel antenna (FPA) technology will track multiple satellites at the same time, using a “pizza box” sized antenna that may be mounted on homes, businesses, busses, trains, planes, boats and even automobiles. As these antennas are produced in large volumes, manufacturing efficiencies will bring their prices down. These antenna will be easy to install, unlike traditional VSAT antennas that have to be carefully aligned and pointed to the satellite. The new FPAs will merely need an open view of the sky in order to “see” the satellites passing overhead, and to track more than one at a time

Communication Technology

Dramatic improvements have taken place in communication technology since the 1990s. RF transmitters can rapidly change power, frequency and modulation schemes under program control. A new era of unlicensed spectrum and spectrum sharing has the potential to significantly increase space based broadband capacity. With a large GEO satellite a particular frequency may be used to provide service to a large region. The same frequency cannot be used anywhere nearby or it will cause interference. The small LEO satellites will have tight hot beams that pass over the earth. The same frequency can be used again and again, as long as these small beams are not placed right next to each other. Laser communications, or very tight RF beams will be used to communicate between satellites in space, so that they can pass traffic from one to the other without causing interference to other satellites

Ground Infrastructure

The terrestrial fiber network has expanded exponentially since the days of Teledesic, which had fewer internet gateways to access. Now internet gateways are all over the world. SpaceX anticipates that it will compete with undersea fiber which often takes long convoluted paths between end points. A connection in space between satellites will be much more direct, and produce lower latency. In the vacuum of space there is less signal loss as compared with fiber optic cable, so more data can be transmitted. Light doesn’t actually travel straight down a fiber cable, it bounces off the sides, reflecting from side to side all the way from beginning to end. This creates “attenuation” or loss of signal which restricts throughput over fiber optic cable in a way that does not occur in the vacuum of space

The Market

Back in the 90’s the internet was just getting off the ground. Today people are trained in the use of smartphones and laptops and everyone is connected to the internet for everything from business, to entertainment, to socializing, to the IoT or “Internet of Things” in which everything is connected to the net. The market is huge, and unlike Teledesic, new players will not have to explain the benefits of the internet – instead new players seek to satisfy growing demand for that connectivity. A digital divide has opened between those who have terrestrial based services and those who have legacy satellite broadband, or nothing. Some are asking if SpaceX actually intends to compete with terrestrial providers in urban areas. We will have to wait and see the price points. They do plan to compete with long haul fiber providers.

The marketing model is poised to change. Where Teledesic had planned to offer services through local service providers, OneWeb and SpaceX have announced plans to sell their services and FPAs directly to end customers. Most customers will be able to easily install their own FPA, and will be able to select service plans online. The expertise and experience of FSS service providers may become less important when many networking issues can be solved by throwing cheap bandwidth at them. Some disruption in the service provider business seems inevitable over the next five years or so.

Challenges

A large hurdle centers on regulatory issues. These companies have to work with licensing authorities to determine how frequency sharing will work, so that they don’t interfere with each other or existing satellite services. These are global networks, so there will be a need to work with all the nations they wish to serve, as well as the International Telecommunications Union (ITU), in order to satisfy regulators. A lot of bureaucracy lies ahead!

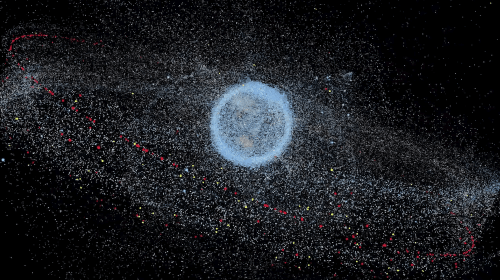

Another concern is falling debris. LEO satellites generally have a useful life of about 5 years, after which they are pushed to de-orbit and burn up in the atmosphere. The potential for personal injury, although small, is nevertheless a topic of discussion. Swarm Technologies’ apparently unauthorized satellite launch has recently brought about the ire of the FCC, and one of their primary concerns was safety and debris. SpaceX has announced that in time, they expect to recapture decommissioned satellites and bring them back to earth.

Political and cultural barriers will likely create problems. Will China, N. Korea, Iran or Cuba allow their citizens to install an FPA and go online? How will Saudi Arabia censor pornography? It is also possible that one or more of the companies planning LEO networks may become a monopoly or oligopoly, creating consumer protection and raising political implications.

Perspective

While manufacturing, launching and operating a new technology seems like a huge engineering task, it’s really quite doable when we look at accomplishments such as the LHC (Large Hadron Collider) or the James Webb Space Telescope. The technology is not at all insurmountable. The question is whether the business model will succeed. It is still too early to say. There is still plenty of time to cast your bets.