Apr 30, 2018

During a recent visit to Satellite 2018 in Washington, DC, the warm basement of the Convention center opened to the main Exhibit Hall, easing the transition from the blisteringly cold wind outside. An item of particular interest this year, was FPA’s or Flat Panel Antennas. How were they coming along, what did they look like, how did they compete, and most of all – what did they cost?

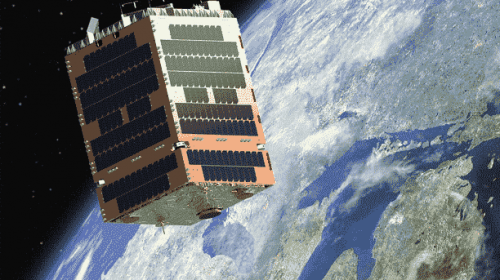

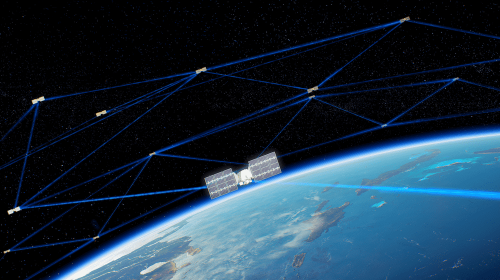

FPAs are the wonder children for the next generation of LEO (Low Earth Orbit) constellations. They are expected to track multiple satellites, to form fit various vehicles, and provide cost-effective solutions for the touted “connected car,” IoT (Internet of Things), and consumer markets poised for explosive growth. How does this future look? How realistic is it?

As has been discussed in an earlier article, FPAs leverage a variety of technologies, some on the bleeding edge, in order to deliver a low-profile antenna that can track and switch between multiple satellites, and deliver high speed broadband. Competing technologies such as phased array and electronically-steered antenna have been discussed previously in more detail. These technologies are quite complex, which leads to costs that unfortunately, are still well out of reach of price-sensitive markets such as the connected car and consumer broadband satellite services. So much for the idea of throwing one in the trunk of the car on the way back from the satellite show…

Northern Sky Research (NSR) sees significant growth for FPAs in the decade ahead, but almost all of it comes from mobility applications that are not as price sensitive, such as aircraft, military and maritime projects. Of $8 billion forecasted by 2027, NSR suggests that mobility applications such as these will account for 91% of equipment revenues. Based on current price points, the market is limited to expensive, high-performing mobility systems.

FPAs shine, for example, when it comes to in-flight internet service. Passengers are demanding the same service they have at home while in-flight, and FPAs deliver low-profiles with low air drag, some even molding to the shape of the aircraft, which simplifies mounting. This market is expected to grow significantly.

FPAs are poised to ease into enterprise and military markets as the next generation of LEO (Low Earth Orbit) satellites begin to be deployed. The demand among larger enterprises for high speed, low latency services will justify still-expensive FPAs, but penetrating the consumer broadband market, and connected car markets will be a challenge. NSR predicts that prices will not fall enough to find a meaningful connected car market anytime soon, but that there will be a market for enterprise applications, such as trains, busses, armored vehicles, delivery trucks, etc. where they will more rapidly deliver a return on investment.

The consumer broadband market will require that very large quantities of FPAs be manufactured in order to drive down costs enough to penetrate that market. For now, NSR does not see that happening to any significant extent in the next decade. Visiting some of the leading FPA vendors at Satellite 2018, prior to launching back into the bitter wind, a couple observations…

As true competitors, the FPA vendors found faults with each other’s products and technologies, but as practical, realistic vendors, their concern was with the legacy mobile antennas – the gimbal antennas – as that is the market they plan to steal away and expand upon.

There is a palpable, growing demand from the many, from the consumers, for a simple do-it-yourself solution for high speed, low-latency broadband satellite anywhere, but given the current state of the art, the market appears to be being driven by the few who have “needs” rather than the many who have “wants.”