Navigating Tariff Challenges Through Supply Chain Restructuring

May 19, 2025

Iridium has initiated comprehensive tariff countermeasures to protect the U.S.-based satellite operator from increasing import tax rates amidst escalating global trade tensions. Historically, the company has primarily imported satellite communications equipment from Thailand to an Arizona distribution center, where these components are combined with other elements before being distributed to customers both within and outside the United States. The CEO, Matt Desch, indicated that the company is expanding a European third-party logistics partnership established in the previous year to redirect nearly all non-U.S. shipments from Thailand, thereby reducing exposure to the latest round of U.S. tariffs. According to Desch, only approximately one-quarter of Iridium’s annual equipment is delivered to U.S.-based customers, with minimal sourcing from China, which faces the most significant tariffs announced recently by U.S. President Donald Trump.

Iridium HQ in Tysons, Virginia. Credit: Iridium

Iridium HQ in Tysons, Virginia. Credit: Iridium

According to the company, the new U.S. trade policies with a 10% tariff on Thailand will cost Iridium $3 million this year and it plans to cover this expense without charging its customers more. Desch mentioned that Iridium may have to pay up to $7 million more if Trump decides to reinstate a 36% tariff on Thailand which was put on hold following its April 2 announcement. Even though they could add extra costs for equipment to their customers to cover some import expenses, the CEO stated that the company is not looking to compromise its success and market position by raising its prices now. By choosing this strategy, Iridium is showing its confidence in its finances and its goal to keep its market share, rather than focus on short-term profit.

Industry-Wide Implications of Increasing Trade Barriers

Even though Iridium is expected to fare well in the short term, analysts expect that the industry as a whole could be affected more by global changes in sourcing. According to Armand Musey, who is an analyst for satellites and founded Summit Ridge Group, satellite companies cannot avoid the effects of changing global trade because they use equipment from many different countries. According to the expert, the biggest issue for companies in the industry would be user devices made overseas or with a large share of foreign parts. Musey added that companies with the fastest-growing customer numbers, mainly in the D2D sector, are expected to feel the strongest impact from these trade policies, although iPhones seem to be spared for the time being.

Iridium promo. Credit: Iridium

Iridium promo. Credit: Iridium

Vietnam, one of the countries with the highest tariffs, exposes foreign component manufacturers to U.S. satellite makers the most. Because of this, their customers could move to new suppliers, disrupting the supply chain in various places. The analyst noted that it is still uncertain whether satellites imported from other countries for U.S. companies would be subject to higher tariffs. Under these rules, the tariff on U.S. purchases of satellites from MDA could be as high as 25% based on the origin of the components. Musey added that due to the world-wide nature of satellites, the retaliation by other countries could influence foreign customers of U.S. companies and negatively affect the whole satellite industry worldwide.

Iridium’s Financial Performance and Competitive Positioning

Revenue for the quarter ending March 31 increased by 5% year over year to $215 million, mainly due to more service sales, mainly from devices used in the Internet of Things (IoT). Net income at the company rose sharply by 53% to $30 million, suggesting that the company managed to perform well, even during tough industry times. The chief executive noted that the emerging market of D2D companies such as AST SpaceMobile which work with terrestrial carriers, should not be considered a market where only one player can win. Since D2D initiatives using cellular spectrum often meet regulatory and interference issues, Iridium’s L-band services which are permitted in space, give the company a major advantage. According to the chief executive, Iridium will begin testing its D2D service with Nordic Semiconductor during the summer. By making use of upcoming chipset standards, this service would allow Iridium-compatible cellular devices to use the network worldwide and the company expects to start making money from IoT devices in the following year.

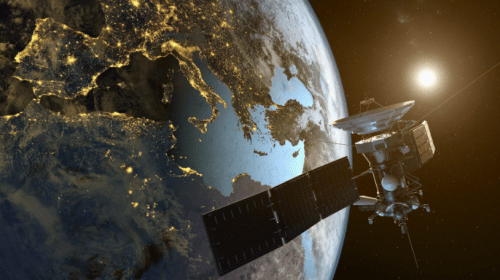

The two fully-complete Iridium Next satellites. Credit: Iridium

The two fully-complete Iridium Next satellites. Credit: Iridium

USAID’s budget cuts have led to a small decrease in Iridium subscribers, but the CEO said that the company is not being greatly affected by U.S. government spending cuts. Desch mentioned that Iridium counts on the U.S. government for about 20% of its business, but commercial IoT and safety-related applications remain the main source of revenue, meaning the company has a well-distributed customer base. In spite of Europe’s efforts to use other suppliers, he stated that Iridium remains trusted and neutral worldwide. This assessment suggests a nuanced understanding of the geopolitical landscape and its potential impacts on international business operations. It seems that Iridium’s strong reputation helps protect it from the rise of initiatives aimed at achieving technological independence. The way Apple manages its supply chain during trade tensions could be a good approach for other technology companies to learn from. Iridium has strengthened its operations by expanding where its products are sold and partnering with companies from different countries. By using this approach, it is clear that the relationship between politics and business in the satellite communications field is well understood.

Strategic Implications for the Satellite Industry

With the changes in global trade, satellite communications providers face both difficulties and new chances in the fragmented market. When companies such as Iridium make changes to their supply chains and operations, the whole industry is likely to be reorganized. Any company that manages to stay competitive and provide quality service will benefit from the changes and improve its market position. During trade disputes, the industry is favored since nations see it as critical to keep reliable satellite services. Still, it does not protect countries from the influence of major economic and global factors. Differences in tariffs among markets explain why having diverse service offerings and customer groups is important. Iridium is confident mainly because it has established itself in markets such as safety-critical communication and IoT connectivity which are harder for others to enter due to strict rules and technical standards. If a company operates in only a few markets, it may be more exposed to trade actions or a slump in that region. Since global supply chains are changing with new policies, satellite operators should always be on alert for possible issues with parts and manufacturing. Redundancy in the supply chain might be necessary to ensure stability over a long period, despite the added costs in the short term, due to increasing trade and technology concerns.