Dec 20, 2017

The satellite industry is undergoing a transformation in a number of ways, one of the most notable of which, is the increase in capacity. It is estimated that by 2025 the industry will have 10 times as much capacity as it has now, helping to put the economics of satellite on a par with terrestrial and wireless networks. This article will take a look at this ongoing transformation.

Airlines

For one thing, there are new markets opening, such as in the Airline industry. Airlines began by providing in-flight connectivity to their passengers, and this service is expected to expand as new flat panel antennas (FPA) are introduced to the market. Airlines are also beginning to connect their entire operations from cockpit and crew to ground maintenance. Northern Sky Research (NSR) has predicted that as many as 23,000 aircraft will be connected by 2025.

Maritime Industry

Another industry experiencing a surge in data is the Maritime market. Cargo ships are using thousands of sensors to collect up to 2 Terabytes of data every three months, with this data providing critical maintenance and operations reporting while the vessel is at sea. Passenger crew ships are also experiencing explosive bandwidth demands that have risen from 10 Mbps per ship to as much as 300 Mbps, and demand keeps growing.

Defense

In the Defense industry, satellite connectivity is being utilized to improve and expand how troops communicate in support of unified missions. Capacity for drones has skyrocketed, as these aircraft are capable of supporting links up to 100 Mbps per drone. This high speed connectivity is being used to support local troops who need to know the situation on the ground, or sent back to headquarters for real time display, or later analysis and review.

Connected Vehicles

Another industry primed for accelerated growth is the “Connected Vehicle.” New flat panel antennas (FPA) are making it possible to outfit trains, busses, trucks, RVs and armored trucks, etc. and supporting a range of applications such as optimizing delivery routes to save on time, fuel and wear and tear, delivering software updates for vehicles or equipment, rescheduling deliveries and uploading maintenance reports. There is also the passenger entertainment component for vehicles such as RVs and busses. There are even partnerships being developed by companies such as FPA developer Kymeta and Toyota to connect automobiles to the internet.

Smart Nation

The “Smart Nation” concept expands the use of satellites beginning with disaster recovery and support for first responders. Teams can arrive on-site at an incident or event, with access to data, VoIP and videoconferencing. Satellite is also being used to monitor utilities, collecting efficiency data and improving how energy is moved across power grids and pipelines, as well as providing remote surveillance of valuable assets. Satellite also plays a role for governments that are trying to provide internet to all citizens, regardless of where they live.

To leverage this new capacity and new applications, satellite technology vendors are hard at work on innovations ranging from ground infrastructure (Hubs, Network Management, etc.) to remote terminals in order to leverage these growth opportunities. New remote hardware will support the latest standards such as DVB-S2X which supports lower roll-off, finer granularity in the extension of the number of modulation and coding modes, extended SNR range, and channel bonding of up to three channels. The “roll off factor” is what determines how abruptly or gradually the signal being transmitted drops off, after being filtered. This feature allows an operator to use less capacity to deliver a certain amount of bandwidth – or to provide more bandwidth using the same amount of capacity. Very low SNR will enhance support for mobile applications, while channel bonding allows the creation of larger carriers to support 4K video channels more efficiently. New remote hardware will also be based on software defined architectures that allow the network to be upgraded and modified based on new demands and applications, with the goal of providing more flexibility and an extended platform life.

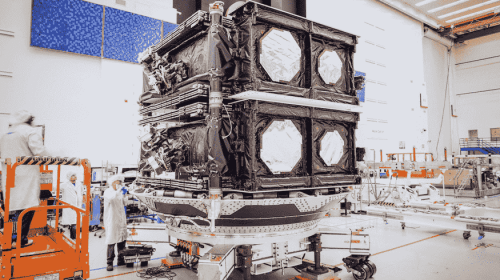

New platforms for hubs and remotes will need to be developed to leverage the increased capacities and capabilities being designed into next generation satellites such as beam hopping, load balancing, and adjustable payloads based on real time demand on the ground. In the satellite industry, both space providers and ground providers, rely on each other to be successful, thus, perhaps more than ever before, ground and air satellite technology vendors are working together to ensure solid ground equipment integration with new satellite capabilities.