How do GEO and NGSO platforms compare?

Jun 11, 2023

BusinessCom Networks, a long-time global provider of broadband satellite services, is in the process of adding new and exciting satellite services to our portfolio. There are many differences and trade-offs between these various alternatives, and we will discuss some of them in this article. We will contrast our global GEO services with new service options from Starlink, OneWeb and SES O3b mPOWER. Services from BusinessCom are or will soon be available for each of these platforms, although coverage is not yet global, and pricing details remain to be worked out in some cases. As we prepare for what appears to be a paradigm shift in our industry, let’s look at the emerging landscape.

NGSO means non-geostationary orbit, which includes new LEO and MEO satellite services. These include services on SES Networks O3b mPOWER MEO (Medium Earth Orbit) and LEO services with OneWeb, and Starlink. We will compare the platforms and then briefly look at how BusinessCom is extending our value adds, such as SecureLink and MSO or Multi-service Optimization, to our own offerings.

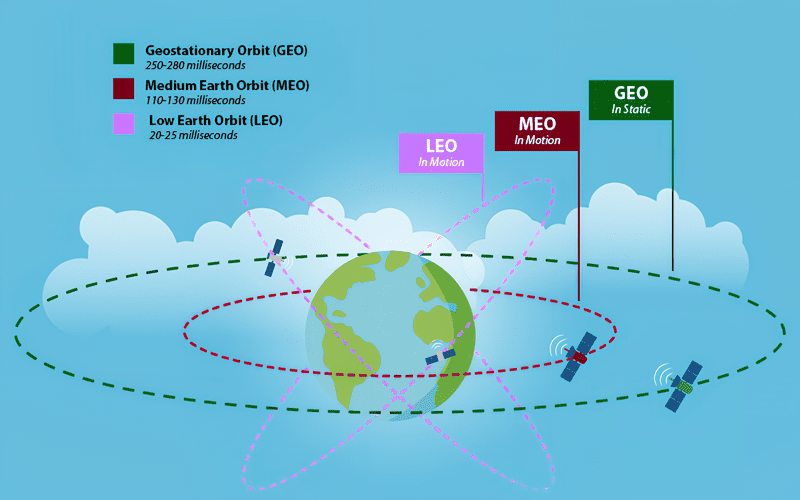

Single trip latency for satellites located in various orbits. Multiply numbers by 2 for round-trip latency. Source: IAS

Single trip latency for satellites located in various orbits. Multiply numbers by 2 for round-trip latency. Source: IAS

How Low Do You Go?

The first thing to understand is that satellite orbits matter. Starlink satellites are very low. This was apparently done in part to avoid mission de-orbit costs. If the satellites are very low, they don’t need additional propellant, thrusters, guidance systems, etc. to move them into the atmosphere to burn up if there are failures, or at the satellite’s end-of-life. This allowed the Starlink constellation to be deployed with lower costs for the satellites. The higher you are, the less atmospheric drag there is on the satellite, so you must have mechanisms in place to retire the satellite. Starlink avoids that by being so low. Because of atmospheric drag, they are coming in anyway, and reportedly will have to be replaced every 5 or 6 years, as they fall out of orbit. Starlink will need to make the business model work by then, to cover the costs of constantly replenishing the constellation.

Since the satellites are so low, they have very small footprints. Think of a flashlight pointed at the ground from 30 cm (1 foot) up. There is a small circle of light. Move it to 1 meter (3 feet) up, and the circle grows larger. Since the orbits are so low, the coverage areas are very small, so they need a great many satellites to provide full coverage. This creates a visibility problem for terminals on the ground, until they have many more satellites deployed. A site must always have an open view of the sky to “see” at least one satellite passing overhead. Obstacles like trees, towers, buildings, mountains, etc. that come in between the antenna and the satellite passing by are going to break the connection, until the next satellite comes by with an open view. However, if a site has a wide-open view of the sky, it reportedly works well. Additionally, the lower the satellite, the more power that can be used to deliver traffic; just as the flashlight’s brightness drops off as you raise it, so too the power from the satellite. The lower the satellite, the lower the latency, which is important for interactive gaming for example.

OneWeb who merged with BusinessCom’s longtime partner Eutelsat recently, OneWeb-Eutelsat-Merger provides a larger footprint with its satellites orbiting at 1200 km (745 miles) compared with Starlink at approximately 530 km (330 miles), so far fewer satellites are required. Starlink’s full coverage calls for 12,000 satellites, while OneWeb will service the globe with 648 satellites. Latency is slightly higher, but not significantly so. Kuiper and Telesat Lightspeed orbits are expected to fall between Starlink and OneWeb along with most spy satellites, which is interesting. Do they complain about Starlink blocking their view of the Earth, as astronomers complain about them blocking the view of the heavens?

The O3b mPOWER constellation orbiting at 8000 km (5000 miles) requires only 11 satellites for global coverage, and these new, powerful, highly flexible satellites will be joining the original 20 O3b satellites, dramatically increasing capacity. See:SES Networks (formerly O3b) update. Starlink has, or will have, a huge fleet of small satellites that will have short lives due to interference with the atmosphere. OneWeb satellites will also have short lifetimes. O3b mPOWER satellites on the other hand are designed to last at least 11 years. Which model will bear out in the long run? A huge number of small short-lived satellites that must be constantly replaced, or a constellation with larger and more powerful satellites, but which last longer, and requires less management? The higher orbiting satellites have an easier time of providing SLAs (Service Level Agreements) that include uptime guarantees such as those that GEO enterprise class services offer today.

Costs

Spot beams and lower orbits leveraging frequency reuse techniques allow LEO and MEO satellites to be more efficient in the use of valuable satellite spectrum and can theoretically offer lower prices to subscribers. However, there are other costs involved, such as maintaining huge numbers of satellites, and the ground systems to support the satellites and the service. Currently Starlink is offering the lowest prices, but this is on an oversubscribed network designed for residential consumers, delivering best-effort services. OneWeb and O3b mPOWER have higher service costs than Starlink, but they deliver fully dedicated, and/or lightly shared services that provide more consistent and reliable services that can be supported with an SLA. GEO services are typically shared from 1:1 (dedicated) to 50:1 (residential). OneWeb services are available with low sharing ratios designed for business customers. O3b mPOWER offers a wide variety of ratios, from 1:16 to 1:1. Starlink employs a FAP (Fair Access Policy) and limits monthly data, like most other residential consumer services. OneWeb and O3b mPOWER offer a range of service options, with varied pricing depending on whether traffic is limited or not.

Starlink currently has the lead on lower terminal costs. As we understand it, Starlink is subsidizing the cost of the antennas, and losing money on each of them until the consumer has had the service long enough to justify it. A major consideration with Starlink is that their antennas are proprietary. They will not work with other providers. They do not currently support the ability to connect to both GEO and LEO services at the same time. Starlink, of course, was designed for the consumer market, so this is not as important for them. Eutelsat has a constellation of high-power GEO satellites, and now with OneWeb, they also have a constellation of LEO satellites. Being able to use one flat panel antenna to access both constellations, depending upon the applications or redundancies required, is under development by flat panel vendors who can work with GEO and LEO satellites. This applies as well to O3b mPOWER and SES, which owns many GEO satellites. There are clients who are going to want to connect to both satellite services at the same time, and OneWeb and O3b mPOWER have a leg up on this capability. Starlink’s proprietary antennas also mean that traffic can only be landed at a Starlink ground station. With O3b mPOWER, for example, clients can set up their own ground station, perhaps a mobile network operator keeping traffic local, or leverage a wide range of existing ground stations.

Initially Starlink wins when it comes to installation complexity and cost, given their terminal is mostly “plug and play” using a smartphone application to deploy the antenna. GEO installations have been performed for many decades and there is a wealth of trained, experienced VSAT installers. The OneWeb service supports either dual parabolic antennas, or flat panel antennas such as those from Kymeta. For O3b mPOWER there are a range of antenna options from .85m to 2.4m. Two of them are required with a third recommended as live spare. These antennas are more expensive and more complex to install and maintain, however they usually support very large circuits.

Data Quotas

Our iDirect Broadband services on GEO satellites, with very few exceptions, provide unlimited data. There are no data quotas, caps, limits, FAPs or throttling. Starlink has recently added a data quota and FAP (Fair Access Policy) that allows them to throttle a subscriber’s upload and download speeds unless additional Priority Access is purchased (for business and mobile service plans). Services from OneWeb and O3b mPOWER are also unlimited – or have that option. Like residential consumer services on GEO satellites, Starlink capacity for the most part cannot be resold, for example to put up Hot Spots or run small WISPs. The new data quota means many businesses are likely to blow through the data quota in days, after which they are billed for overages or throttled. The data quota will help prevent that from happening. OneWeb is designed for enterprise clients. O3b mPOWER, on the other hand, can support mobile network operators and ISPs with backhaul services.

Speeds and Feeds

Starlink beats GEO satellites on capacity, offering bandwidth rates of 50 – 200 Mbps, while typical GEO satellites run from 1 to 50 Mbps. OneWeb supports similar data rates as Starlink of 10 – 200 Mbps, however O3b mPOWER wins the speeds and feeds contest supporting up to 1 Gbps and providing support for very large circuits.

Many applications require guaranteed throughput or CIR (committed information rate) such as VoIP and video if guaranteed quality is desired. We provide CIR on practically all our GEO satellite services, as part of the overall burstable bandwidth. Starlink’s service, as we understand it, is a “best effort” service with no CIR. Dedicated CIR is supported on BusinessCom’s GEO, OneWeb and O3b mPOWER services.

Latency

Of course, all LEO and MEO options will have better latency than GEO satellites. Although technology provides TCP Acceleration techniques to overcome many of the drawbacks of GEO latency, there are some applications like interactive shoot-em-up gaming that don’t work well on GEO satellites, and voice will have a slight but noticeable delay which won’t be the case with MEO and LEO services. Lower latency also contributes to higher throughput, even if the latency isn’t problematic to the application. For larger companies, the ability to leverage both LEO/MEO and GEO services means they can put traffic such as streaming video that is not latency sensitive, on GEO satellites and put latency sensitive traffic on the new constellations. Starlink, with its proprietary hardware, will not be able to do this. Starlink user antennas will only work with Starlink satellites.

Ground Station Infrastructure

Starlink has its own ground station network, while GEO satellites and O3b mPOWER have the ability and flexibility to land at teleports providing access to EU/US Tier 1 ISPs and SaaS Clouds. Starlink will have to relay traffic, and they will essentially own their customer’s traffic. Both OneWeb and O3b mPOWER have relationships with large Cloud providers such as Microsoft Azure so being able to collocate with those content delivery providers offers a huge advantage for enterprises over Starlink. Unlike GEO satellites that are fixed in place and cover a wide territory, LEO satellites cover a small patch of Earth, and they must land the client’s traffic somewhere within that same small beam, so many ground stations are required, adding to cost, complexity, and maintenance. This can be alleviated to some extent by using ISR or inter-satellite relay links. In this case the traffic is passed satellite to satellite and then down to a desired ground station. Adding ISR into the mix means using capacity, processing power and memory for relaying traffic instead of passing customer traffic and it adds another layer of complexity to an already complex network. How well this is going to scale is still open to debate, particularly when there are thousands of satellites involved. This issue is surely of great concern to Starlink as they must build their own ground stations, given their proprietary antennas. OneWeb has a larger footprint to work within, and because the antennas are standard, traffic can be landed at existing teleports without building out all new infrastructure. O3b mPOWER at an even higher elevation has even greater flexibility, and by leveraging software-designed satellite technology (see Software Designed Satellites) the mPOWER beams can be steered to land wherever the client needs them to land. Unlike standard satellites in which transponders are fixed, a software-designed satellite such as mPOWER can be reconfigured to reallocate bandwidth and beam coverage, as needed.

Customization and the BusinessCom Difference

Most services these days are cookie-cutter, with little to no customization possible. BusinessCom, for example, offers customized QoS to help clients manage how their bandwidth is used. Currently this feature is not available on generic Starlink or OneWeb services. BusinessCom’s NGSO services on LEO and MEO will include our standard features such as unlimited data, bi-directional QoS, encryption, network intrusion detection and bandwidth management as part of our service offering. We will include SecureLink which monitors circuits for malware, identifies it and informs users. Finally, BusinessCom’s new MSO or Multi-Service Optimization is a profile driven feature that optimizes capacity allocation for important applications that frees up capacity for important applications. Multiple profiles can be used to optimize business traffic, or perhaps invoke a social media profile that the system switches to after business hours. MSO has provided our customers with significant improvements in throughput for their business traffic, without adding additional bandwidth.

Starlink is also like residential consumer services on GEO satellites, such as HughesNet and Viasat, insofar as the SLA basically agrees to take your money, and not much else! BusinessCom offers packet loss and network availability guarantees in our SLA for GEO services, and we provide credits when SLA guarantees are not met. (Very rarely). In addition to an SLA, BusinessCom’s NGSO services will support the same features we offer to our GEO customers, such as throughput and protocol use, bandwidth packet and loss monitoring. We are porting these features and capabilities from our GEO services to our LEO services.

Summary

What does all this boil down to? Answer: Options.

GEO satellites aren’t going away. They are extremely reliable, have large coverage areas, and pricing has continued to trend down. There will be places where there isn’t enough “open sky” to use a LEO service, while a line-of-sight can be made to a GEO satellite.

BusinessCom OneWeb will also provide these capabilities. This service, while initially designed for the consumer market, has evolved into an enterprise class service. We offer this service in the northern hemisphere and expect to have full coverage at the end of the year (2023) after a few more satellites are launched. OneWeb’s higher altitude makes an uptime SLA easier to support, and its support for standard antennas and ground stations, makes it more flexible for larger business customers.

O3b mPOWER is available and typically directed to clients who need trunking or backhaul circuits or have requirements for other large circuits. The technology on the mPOWER satellites provides very flexible, reconfigurable, steerable, beams where sophisticated clients need such capabilities to support complex applications.